What is a customs power-of-attorney? A customs power of attorney is used to give the authorized agent authority to act in all matters related to the import and export of goods and customs. It's a short legal document consisting often of one page. Some countries provide their own form to be used, such as customs form 5,000 291. In the United States, the grantor can be an individual, partnership, or corporation. Much like the agent, who is also called the attorney of the grantor, the customs power of attorney also grants rights to the employees of companies who act as agents with limited authority when dealing with customs. - The type of agent who would sign a customs power of attorney is often a customs broker, export forwarding agent, or import agent. A grantor may list the help of all three but will often use separate documents for each. A customs broker works on behalf of someone else or a company to clear goods through customs and is regulated by the government entity responsible for Customs and Border Protection in the country. An export forwarding agent or import forwarding agent prepares the goods to leave the country and ensures they conform to customs shipping requirements. Forwarding agents also handle the necessary paperwork required by customs and often submit the goods and paperwork to the grantor, customs broker, or other agent acting on the grantor's behalf. - The grantor is often a resident or foreign company involved in importing and exporting products, but individuals may also request the assistance of agents to facilitate the shipment of items in or out of a country. The grantor relies on the agent to handle import/export and transportation of merchandise or other items, either because they are unable to personally handle customs procedures or because it is...

Award-winning PDF software

Cbp 5291 Form: What You Should Know

Last Four digits of SSN of Individual (if not U.S. Citizen). 3. Last Four digits of SSN of Foreigner (if not U.S. Citizen). 4. Business address (Street, City, State) with City, State, Zip Code. 5. Date of Birth (Day, Month, Year). CBP Form 5291 must be accompanied by a photocopy of the applicant's passport or any other document issued by or under the authority of the United States Government that shows a signature (including U.S. CITIZENSHIP CARD or CARD FOR IMMIGRATION). If a Power of Attorney has been granted by a Foreigner, the following items must be on a Form 5291, with a copy of the Power of Attorney executed: 1. Date (day, month, year). 2. Name and current address. 3. Power of Attorney (if not a general power of attorney). 4. Date of this form, and 3 business items (if applicable) on each page of the Form 5291 (listed on the next page). 5. Signature of the signatory and 4 of the following 8 names. If a Power of Attorney has been granted by a Domestic Entities, the following items must be on a Form 5291 : 1. Date (day, month, year). 2. Name and current address. 3. Name, address, and telephone number (if known), and number of person to contact for further inquiries. 4. Name, address and telephone number of other persons to be contacted including the address of the location of this individual and contact person. If a Foreign General Power of Attorney is on a Customs Form 5291, the following items must be on the same form CBP Form 5287 (09/28). Partnership. Has caused these presents to be sealed and signed. (Signature). (Date). (Capacity). WITNESS:. CBP Form 5287 may be used for giving power of attorney to transact Customs business. If a Power of Attorney is not on a Customs Form 5287, it shall be either a general power of attorney with unlimited authority or a limited power of ATTORNEY Jul 31, 2024 — ICON CEL Form 6 (07/29): (This form is a duplicate of U.S. Customs Forms 6096 (09/13) and 5291 (09/13). The only difference is that it is for a foreign entity and not a U.S.

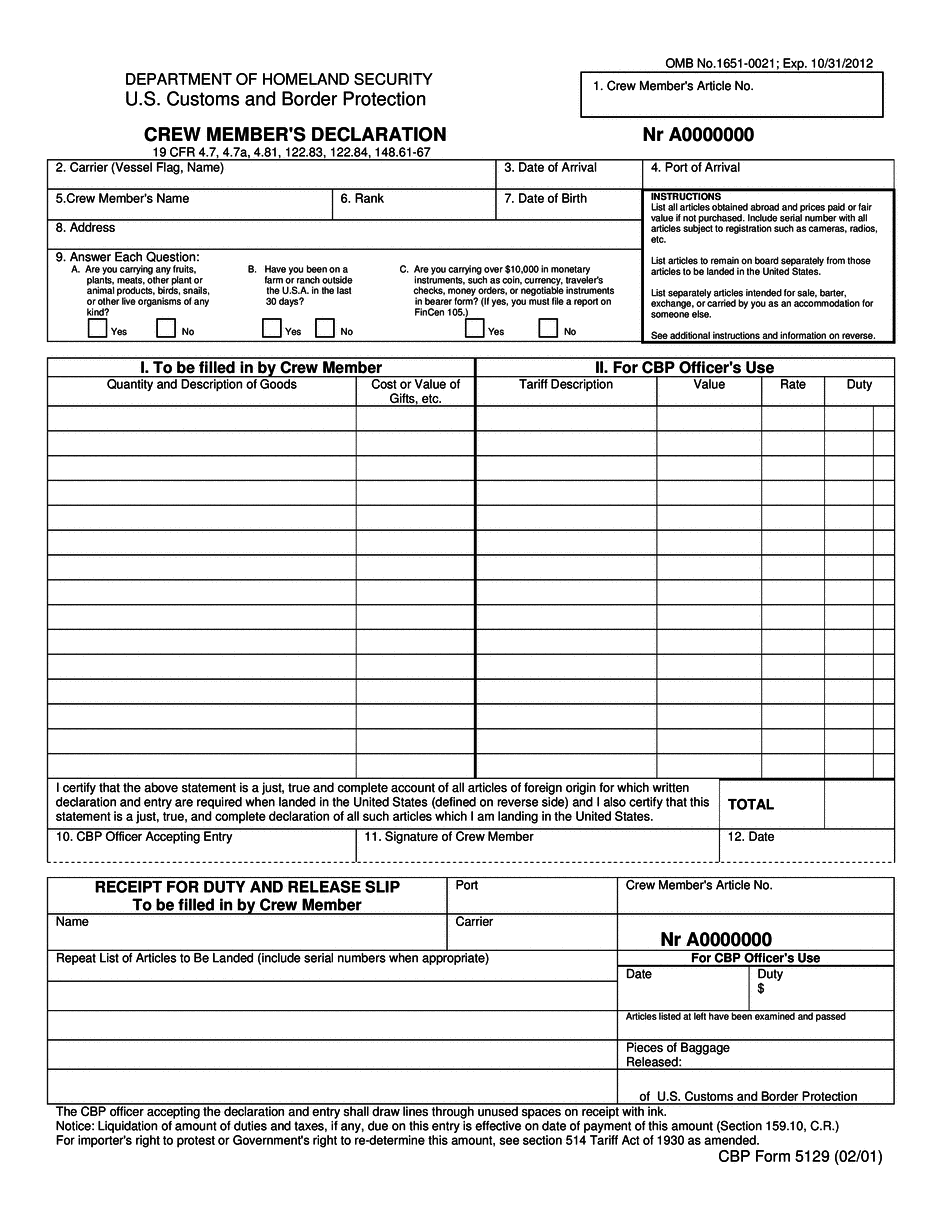

Online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Cbp Form 5129, steer clear of blunders along with furnish it in a timely manner:

How to complete any Cbp Form 5129 online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Cbp Form 5129 by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Cbp Form 5129 from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing Cbp form 5291